India’s data centre industry capacity to triple by 2025 to 1078 MW[1]

Real estate investors reimagine India's data center market as it presents an investment opportunity of USD 4.9 bn during next five and half years ending 2025

A peep into the world’s second-largest, internet-hungry user market throws some impressive numbers and its implications.

- Indians consume ~1500 GB data every second as per the latest published data[2]

- Average cost of the data is US$0.17 per GB – the cheapest daily necessity

- Data centres playing pivotal role in keeping digital economy operational during the pandemic

- Personal Data Protection Bill – Draft act under discussion

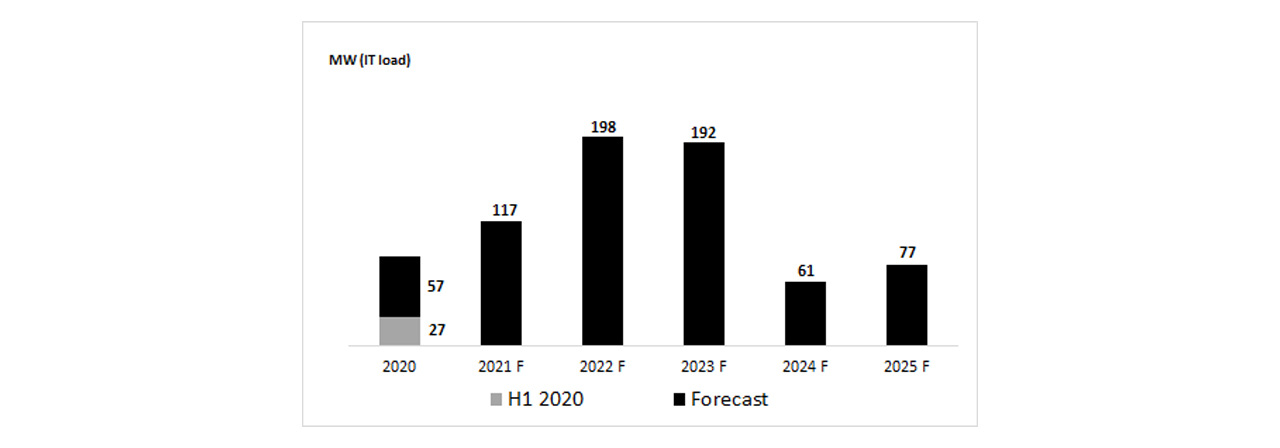

Figure 1: India’s DC industry to witness 703 MW capacity addition during 2020- 2025

India’s wireless data subscribers grew by 2.5 times from 280 mn to 700[3] mn from 2015 till January 2020, registering y-o-y growth of 20%.The unprecedented growth of data consumption created the need for data centres to store and maintain this vast resource. The data usage increased further due to work from home, online education and recreation in the backdrop of COVID-19 led nationwide lockdown. Industries such as IT/ITeS, BFSI, e-commerce, capital markets, social media and online education remained operational due to India’s 375 MW[1] data centre capacity.

Data being the new resource, makes it imperative to device necessary laws to protect personal information and its storage. The draft Personal Data Protection Bill, draft e-Commerce Policy and the Reserve Bank of India’s notification on the local storage of payment data – all these developments point towards the requirement for local storage of data. The scenario spells a significant opportunity for Indian data centres or colocation industry.

JLL research believes that data localisation is likely to be a major driver for the domestic industry over the next five years. India’s data centre capacity is estimated to increase from 375 MW as of June-2020 to 1078 MW by 2025. This capacity addition will lead to an additional need for 9.3 million sq. ft. of real estate space over the existing 8.4 million sq. ft, occupied by domestic data centres.

Looking for more insights? Never miss an update.

The latest news, insights and opportunities from global commercial real estate markets straight to your inbox.

Mumbai and Chennai will account for 70% of share of these new capacity additions.

In our ‘connected’ world driven by the Internet, increasing speed, lower latency and falling costs are leading to more unique applications every day. The advent of 5G is set to unleash a fresh wave of change that will redefine many industries.

India’s domestic data centre industry is thus expected to benefit from the increasing use of data in areas like over-the-top media services and e-commerce. New emerging areas like Internet of Things (IoT), industrial IoT, healthcare and connected devices will provide additional growth.

Investment Opportunities

The prospects offered by the Indian data centre industry have attracted global players as well as investors who have already invested US$ 800 million in the last decade. The new capacity is expected to provide a new investment opportunity of US$4.9 billion. The Indian data centre industry is set for an exciting growth phase providing new opportunities for the real estate sector.

[1] MW- IT power load in Mega Watt

[2] Telecom regulatory authority of India reports

[3] Telecom regulatory authority of India reports

What’s your investment ambition?

Uncover opportunities and capital sources all over the world and discover how we can help you achieve your investment goals.